- The SEC is trying to get decentralized platforms under control

- What is an exchange?

- A conflict within the SEC

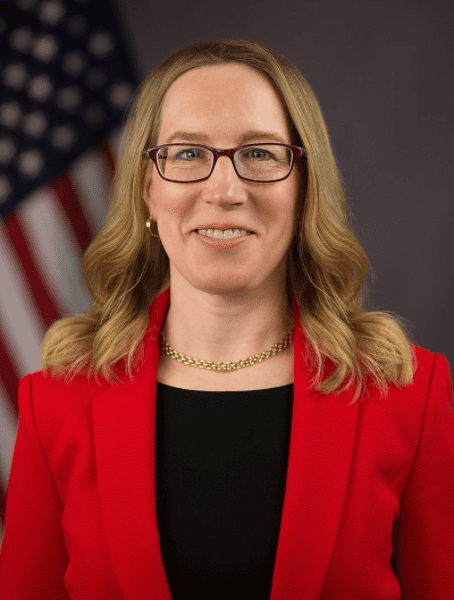

Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission (SEC), disapproves of the agency’s idea to include decentralized crypto platforms into the amended definition of an exchange. She believes that this change could hinder the development of crypto. Peirce published a statement under the title of “Rendering Innovation Kaput.”

The SEC is trying to get decentralized platforms under control

On April 14, the SEC renewed its 30-day comment period for amendments to Exchange Act. According to the new definition, “exchanges” would include DeFi platforms. The commissioner Hester Peirce believes that this change would constitute an attack on the development of crypto.

The very same day, Hester Peirce published a statement. “Rather than embracing the promise of new technology as we have done in the past, here we propose to embrace stagnation, force centralization, urge expatriation, and welcome extinction of new technology. Accordingly, I dissent,” she commented.

What is an exchange?

According to the change, initially proposed in January 2022, the definition of an exchange would include platforms that use “communication protocol systems” — defined by the Commission as “trading systems that offer the use of non-firm trading interest and provide protocols to bring together buyers and sellers of securities.”

“Make no mistake: many crypto trading platforms already come under the current definition of an exchange,” Gary Gensler, the Commission’s Chairman, said in his comment published the same day.

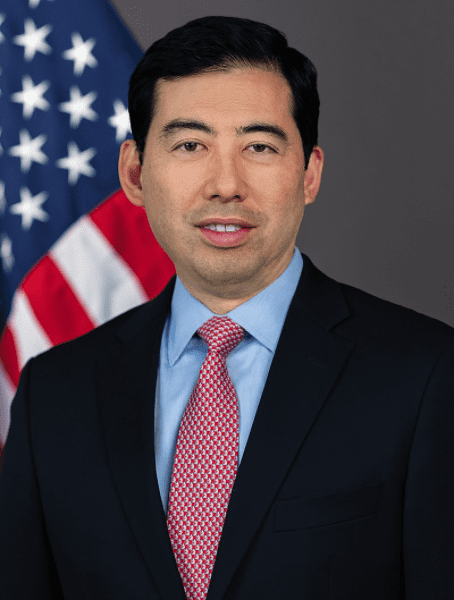

Three out of five SEC commissioners have supported the amendment. The only ones who voted against were Hester Peirce and Mark T. Uyeda. The latter emphasized that the amendment raises more questions than it addresses “in terms of what is, and what is not, an exchange for purposes of the Exchange Act.”

According to Peirce, the Commission does not provide clear examples of “communication protocol systems”. She adds that the ambiguous nature of its definition could lead to disruptions for numerous businesses and the market in general.

Known as an active proponent of crypto and even dubbed “crypto mom”, Peirce stated that the suggested standards would be too broad and unclear and would limit the activities of crypto players, and as such they would undermine the First Amendment rights.

A conflict within the SEC

Since two commissioners have opposed the amendment, the Commission is divided on what to do next. The Investor Advisory Committee published an open letter on April 6. It requested that the SEC should continue its aggressive enforcement against crypto firms in order to protect investors from illegal activities.

The regulatory authorities in the U.S. are more chaotic than the crypto industry which has its own rules and regulations. Of course, there is still a long way to go until stability is achieved, but the regulatory authorities are only getting in the way of the natural course of events.