- Advantages of crypto VC funds

- Risks of crypto VC funds

- Results of crypto VC funds

- Examples of successful crypto VC funds

- Conclusion

Crypto VC funds are designed for investing in projects related to crypto and blockchain. By working with such funds, investors get the opportunity to expand their portfolio and benefit from promising startups in the continuously developing crypto industry. However, apart from offering undeniable benefits, such funds also come with certain risks.

Advantages of crypto VC funds

The main advantage is the potentially high profitability and the opportunity to profit from successful projects. Crypto VC funds invest in startups and projects that have the potential for rapid growth and high returns.

The crypto industry is growing rapidly, and successful projects can generate significant returns for their investors. The possibility of high returns attracts many investors who are willing to take the risk and invest their money in crypto VC funds.

Risks of crypto VC funds

Low liquidity and difficulty in withdrawing investments

Crypto-related projects and startups usually require long-term commitment, and withdrawals can take a long time. The crypto market is known for its high volatility, which can make it difficult for investors to withdraw their funds. Some crypto VC funds may have withdrawal restrictions, making investments less liquid and requiring investors to be patient.

Possibility of getting involved in scams and losing one’s money

The crypto and blockchain market is not as strictly regulated as traditional finance. As a result, it attracts scammers and fraudsters. Investors in crypto VC funds may be at risk of losing their money if they invest in unsuccessful or fraudulent projects. Investors should be aware of the risks and thoroughly analyze projects before investing their money.

Results of crypto VC funds

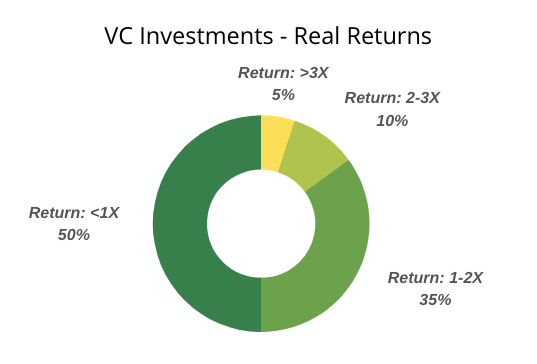

As crypto VC funds operate in the volatile crypto industry, they are always associated with high risks. Studies have shown that no more than 50% of projects turn a profit. However, the profit margins are often high enough to cover the losses of the other 50%.

Most of the funds are invested in IT projects. For example, having once invested in a small social network service set up by students and originally known as TheFacebook, the general partners of Accel Partners and Founders Fund are still at the top of the Forbes list of the world’s most successful investors.

Examples of successful crypto VC funds

Pantera Capital

Founded in 2013, Pantera Capital is one of the most famous crypto VC funds. It invests in various crypto and blockchain projects, including startups, tokens, and digital assets. The fund has a successful investment track record and has worked with such projects as Bitstamp, Ripple, and Circle.

The fund invests in many cryptocurrency and blockchain-related projects at different stages of development. It provides not only funding but also strategic support and advice to its portfolio companies. Pantera Capital has a successful track record and its companies have achieved significant success.

Blockchain Capital

Blockchain Capital is also one of the leading crypto VC funds founded in 2013. It focuses on investing in companies that use blockchain technology for a variety of purposes, including financial services, healthcare, and logistics. This fund has a successful track record and has invested in such projects as Coinbase, Kraken, and BitFury.

The fund also provides expert support and business development assistance to its portfolio companies.

Andreessen Horowitz

Founded in 2009, this VC fund is one of the largest and most successful funds in Silicon Valley. In recent years, Andreessen Horowitz has been actively investing in crypto and blockchain-related projects. The fund has invested in projects such as Coinbase, Ripple, and MakerDAO.

The fund provides a wide range of support to its portfolio companies, including funding, strategic assistance, and network resources. Andreessen Horowitz has a track record of successful investments in the crypto industry and plays an important role in its development.

Conclusion

Potential investors interested in cryptocurrency and blockchain-related projects should consider these successful crypto VC funds. They have a long and successful track record of investing in crypto projects and offer not only funding but also expert support and strategic advice to their portfolio companies.

Organizations looking to partner with such funds are advised to do thorough research and preparation to present their project in the most favorable light. It is important to demonstrate the project’s potential and value to investors, and to be prepared for the cooperation and support these funds can provide.

Overall, crypto VC funds represent an important and actively growing investment segment. Their successful results and investment strategies demonstrate the prospects and potential of this industry. Potential investors and projects can use these recommendations to successfully cooperate with such funds and contribute to the development of crypto and blockchain.