- The study shows mixed results

- Criminals are targeting centralized exchanges

- Reports are supported by alternative research

In August, Chainalysis published a mid-year crypto crime report. According to the findings, while overall criminal activity decreased by nearly 20%, the number of ransomware and hacker attacks increased significantly. Crypto crimes resulted in losses of 1.2 billion.

The study showed mixed results

Chainalysis analyzed the crypto crimes committed and reported that the total illegal activity for the first half of 2024 decreased 19.6% year-over-year to $16.7 billion. However, the numbers are “lower-bound estimates based on the influx of funds to illegal addresses we identified today” and “will almost certainly be higher” as Chainalysis identifies more addresses definitely linked to crime.

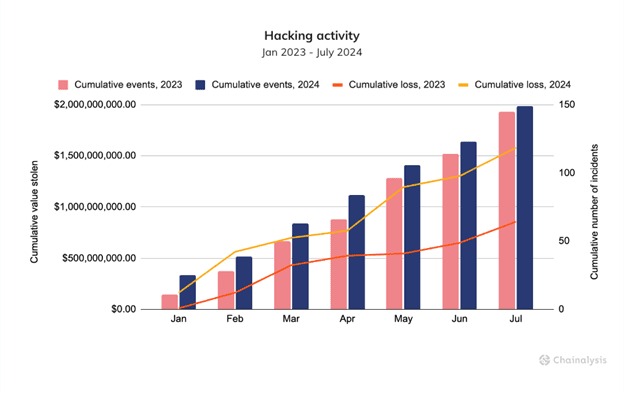

While the decline is encouraging, the amount of funds stolen from cryptocurrency thefts in the first half of 2024 rose to $1.58 billion from $857 million last year, even though the total number of hacking incidents increased by only 2.76% year-over-year. The surge in dollar value was blamed on the rise in the fiat value of tokens from 1 to 2023, a period when the entire digital asset sector was still recovering from the onset of the “crypto winter” in mid-2022.

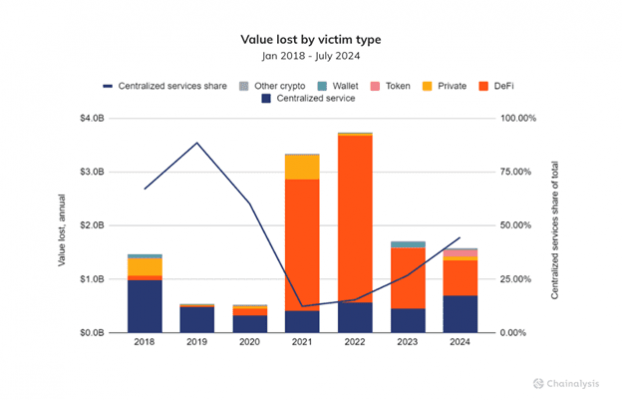

The biggest hack this year – the theft of $305 million from Japanese exchange DMM in May – shows that hackers are increasingly targeting centralized exchanges, unlike in years past when decentralized finance protocols (DeFi) were the main targets. Chainalysis says this shift is likely due to the yearly increase in the value of the BTC token, which is not traded on DeFi exchanges.

Payouts from ransomware totaled $459.8 million by the end of June, slightly higher than the $449.1 million paid out at the same point last year. That’s partly because individual ransomware payments set new records, led by the $75 million paid by an unidentified victim to the group Dark Angels. That amount was nearly double the largest payment in 2023 and 335% higher than the largest payment in 2022.

Ransomware attacks are also becoming more frequent, up 10% year-over-year. However, victims are increasingly refusing to pay and the number of “payment events” has fallen by 27.3%, suggesting that businesses/individuals are getting better at dealing with the impact of such incidents.

Criminals are targeting centralized exchanges

Analyzing crypto crime, we can conclude that after a 50% drop in stolen cryptocurrency in 2023 compared to 2022, there is a spike in hacking activity this year. The value stolen this year through the end of July has already reached $1.58 billion and is about 84.4% higher than the value stolen during the same period last year. Interestingly, the number of hacking incidents in 2024 is only slightly higher than in 2023, increasing by only 2.76% year-over-year. Meanwhile, the average amount of value compromised per event increased by 79.46%, rising from $5.9 million per event from January through July 2023 to $10.6 million per event in 2024, based on the value of assets at the time of the theft.

Much of the change in the value of stolen assets is due to price increases. For example, the price of Bitcoin rose from an average price of $26,141 in the first seven months of 2023 to an average price of $60,091 this year through July, an increase of 130%.

Reports are backed up by alternative research

Immunefi, a hacking and security risk research company for DeFi platforms, claims that fraudsters have committed 154 individual hacks this year, earning more than $1.2 billion. Crypto crimes generated 15.5% more revenue for attackers than the same period last year, driven by the DMM hack and a similar attack on Indian exchange WazirX, the latter resulting in $230 million in lost customer funds. Immunefi officials said nearly $15.1 million of the year-to-date total was stolen in August, of which $12 million was stolen from the troubled Ronin network.

Blockchain security firm PeckShield said hackers stole nearly $313.4 million in August, of which $293.4 million came from two separate phishing attacks.

Another blockchain specialist, Scam Sniffer, said $63 million was lost to phishing attacks in August, including one truly unfortunate individual who lost $55.4 million in DAI, an Ethereum-based stablecoin, after mistakenly signing an owner-changing transaction in the DeFi vendor protocol.