- What Is a Stablecoin and Why Does It Matter?

- Why Is MetaMask Launching Its Own Stablecoin?

- How Will the MetaMask Stablecoin Work?

- Conclusion

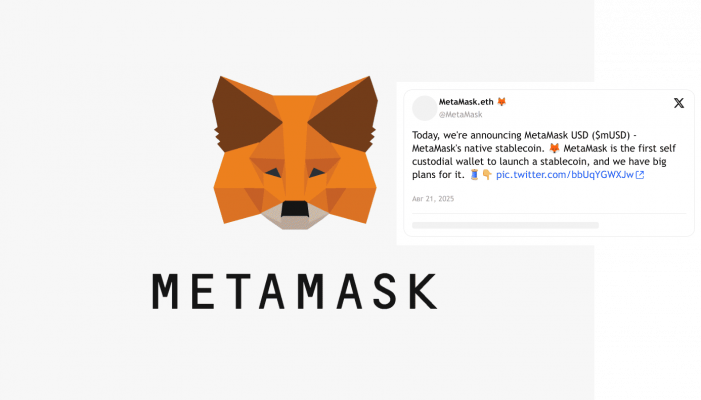

MetaMask is one of the most widely used crypto wallets and a crucial bridge between users and decentralized applications (dApps) in the Ethereum ecosystem. The company recently announced the launch of its own stablecoin—a move that could have a major impact on the cryptocurrency market and the future of Web3.

What Is a Stablecoin and Why Does It Matter?

A stablecoin is a cryptocurrency that is pegged to real-world assets, most often the US dollar, euro, or other fiat currencies. The main purpose of stablecoins is to maintain a steady value, unlike volatile assets such as Bitcoin or Ether.

Stablecoins simplify transactions, protect against market fluctuations, and facilitate the integration of crypto into everyday payments and business processes. They are widely used in trading, decentralized finance (DeFi), payroll, and cross-border transfers.

Why Is MetaMask Launching Its Own Stablecoin?

As a cornerstone of Ethereum and Web3 infrastructure, MetaMask has long been at the center of crypto activity. Launching its own stablecoin is a natural step that strengthens its ecosystem and expands the wallet’s functionality.

Strengthening the MetaMask Ecosystem

With an in-house stablecoin, users will be able to transact in a reliable digital currency directly inside MetaMask. This reduces reliance on third-party stablecoins and intermediaries while making interactions with dApps more seamless.

Improved Convenience and Security

A native stablecoin backed by transparent reserves and built directly into the wallet, enhancing usability and trust. Users will be able to move funds, pay for services, and participate in DeFi protocols without needing to purchase or swap external tokens.

New Revenue Streams and Growth

For MetaMask, the stablecoin represents more than just convenience—it’s also an opportunity to diversify its business model. It paves the way for new financial products, integrated services, and additional monetization opportunities centered around the stablecoin.

How Will the MetaMask Stablecoin Work?

While MetaMask hasn’t revealed all the technical details yet, it’s confirmed that the stablecoin will be pegged to the US dollar and backed by reserves subject to regular audits. The token will be fully compatible with Ethereum and available in MetaMask without extra setup.

Technology Stack

The coin will be issued under the ERC-20 standard (or its updated versions), ensuring wide compatibility with decentralized exchanges, DeFi protocols, and Ethereum-based services.

Governance and Transparency

MetaMask has emphasized its commitment to transparency, promising open reports on reserves and audits. Community-driven governance mechanisms (via a DAO) may also be introduced to involve users in the token’s future.

User Benefits

MetaMask’s stablecoin will make in-wallet transactions faster and easier while lowering fees and reducing risks associated with swapping between multiple stablecoins. It will also serve as a foundation for new financial services natively integrated into the MetaMask ecosystem.

Risks and Open Questions

Regulatory pressure on stablecoins varies across jurisdictions and could significantly affect the token’s adoption. The project’s success will also depend heavily on user trust in MetaMask’s reserves and risk management. Finally, it will face tough competition from established stablecoins such as USDT, USDC, and DAI.

Conclusion

The launch of a MetaMask stablecoin marks an important milestone that could reshape the wallet experience and strengthen the Web3 ecosystem. It promises simpler, safer, and more transparent transactions while opening the door to new Ethereum-based financial services.

MetaMask’s move reflects a broader trend in the industry toward creating integrated, user-friendly, and stable financial tools for the crypto economy. In the near future, we can expect more details, pilot launches, and test phases that will reveal the real potential of this new product.