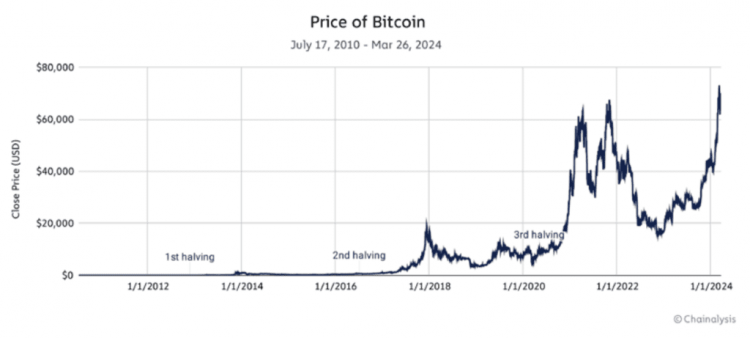

Price trends around historical halving events

Historically, the Bitcoin price has shown an upward trend after a halving event.

After halving in 2012, the price of Bitcoin rose significantly, going from $12 in November 2012 to over $1,000 in November 2013.

A similar pattern emerged after the halving in 2016, with the Bitcoin price rising from $650 in July 2016 to around $2,500 in July 2017 and eventually reaching a new all-time high of $19,700 in December 2017.

After halving in 2020, the Bitcoin price rose from around $8,000 in May 2020 to a new all-time high of over $69,000 in April 2021.

These trends suggest that historically the Bitcoin price rose for a year after the halving, but was followed by a period of price adjustment. Unlike previous halving cycles, Bitcoin reached a new record high in March 2024, about a month before the upcoming fourth halving.

Supply and demand dynamics

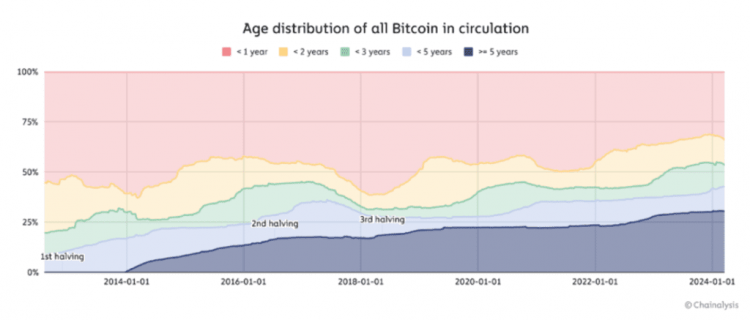

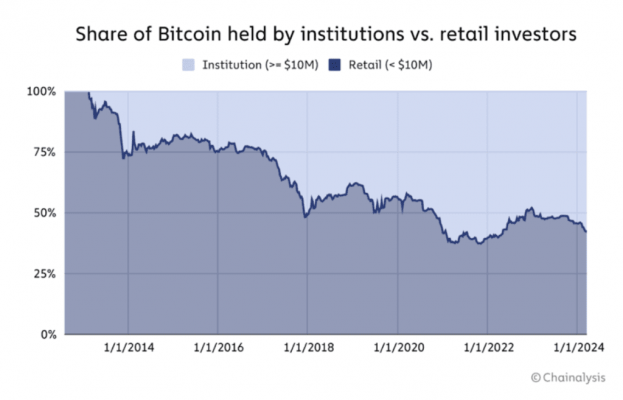

Halving events directly impact Bitcoin supply by reducing the rate at which new Bitcoins are created. This, combined with steady or growing demand, especially from institutional investors and retail adoption, tends to push the price up. Anticipating such a reduction in supply could lead to increased restraint among existing Bitcoin holders, further reducing the supply of liquidity available on exchanges.

The percentage of Bitcoin held by long-term investors (more than 3 years) has shown a steady increase after each halving. About a year after the first halving, the percentage of Bitcoin held by long-term investors increased by about 73%. The period following the second and third halving showed moderate growth, continuing the overall upward trend.

ETF participation in this halving cycle introduces a new dynamic, potentially amplifying the impact of halving compared to previous events. This halving could lead to an even larger supply shock, driven by a combination of reduced mining fees and increased institutional buying caused by ETFs outpacing the creation of new coins. In turn, this could drastically reduce the amount of Bitcoin available for trading, increasing price volatility.

The percentage of Bitcoin held by institutions that own more than $10 million has increased after each halving. They now hold the majority of Bitcoin in circulation.

Impact on Bitcoin miners and profitability

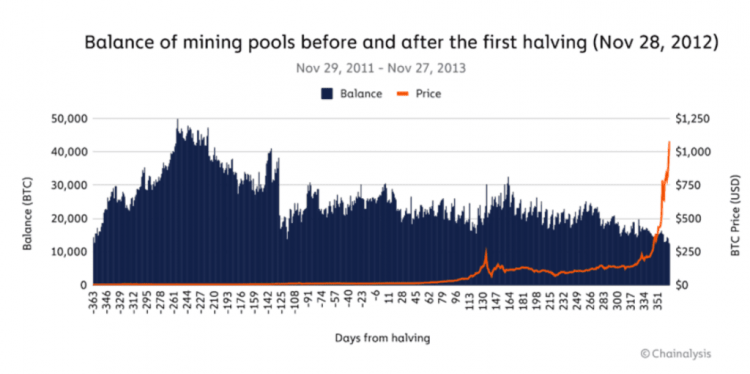

For miners, halving events reduce the immediate reward for mining new blocks. This can lead to a temporary decline in profitability, especially for miners with higher operating costs.

However, price increases following a halving event have historically allowed miners to recover revenue despite lower blockchain rewards.

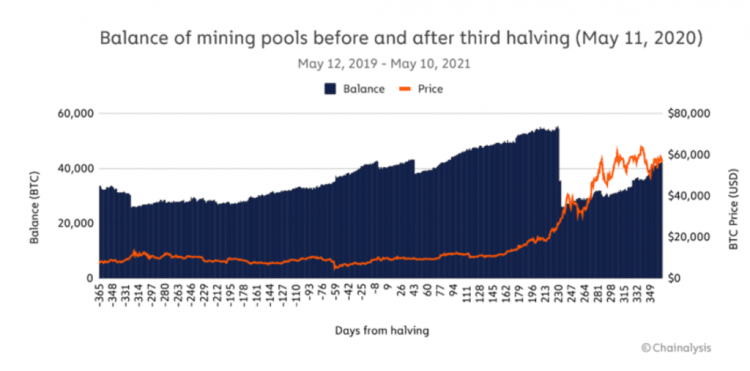

The aggregate balance of mining pools declined for about 3–6 months before the first and second halving. This decline is attributed to miners presumably building up cash liquidity in anticipation of reduced block rewards.

After the first and second halving, the price increased for one year, leading to a recovery in miners’ revenues as block rewards declined.

The third halving showed a different structure compared to the first and second halving. It seemed that established miners waited for the bullish downturn to sell their reserves instead of selling them before the halving. This could be due to the expectation that Bitcoin’s price will rise after halving based on the previous two events, making it more profitable to hold it longer.

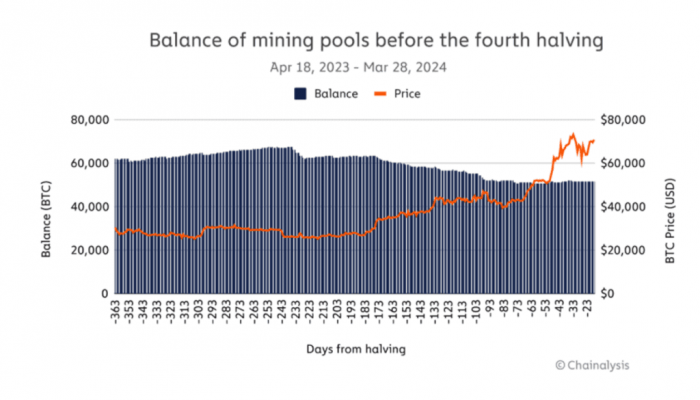

At this point, ahead of the fourth halving, reserves have declined by about 23% since October 18, 2023, which is about 180 days before the expected halving date in mid-April. However, this decline is not as significant as observed during the first and second halving. This could be due to expectations similar to the third halving, cashing out after further price increases following the halving, or the recent significant increase in the Bitcoin price, allowing short-term reserves to be prepared without having to sell as much Bitcoin as during the first and second halving.

What the fourth Bitcoin halving means for the cryptocurrency

The fundamental mechanics of this halving are unchanged from previous halving events: reducing the rate of Bitcoin issuance to increase scarcity. However, the broader context in which this upcoming halving is taking place is markedly different, and the implications go beyond supply mechanics.

There is an unprecedented level of anticipation amidst the historic interaction of institutions. Institutions have not just entered the market, they are now shaping its trajectory, bringing with them a new level of trust, stability and interest from mainstream financial institutions. Bitcoin’s growing integration into the global economy is paving entirely new paths for increased demand and utility.

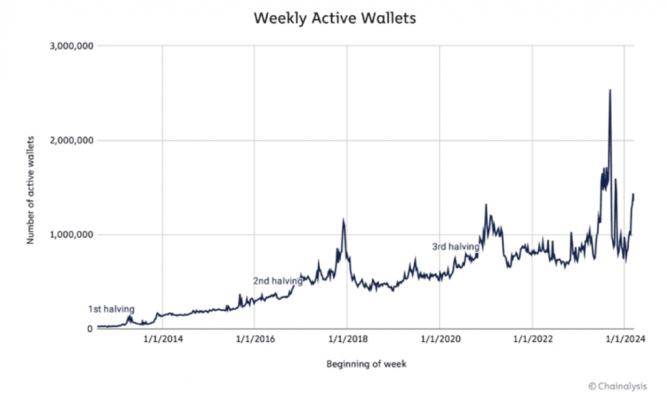

The consistent growth in weekly active wallets since the halving event demonstrates the growing use and adoption of Bitcoin.

This halving event is just part of a process that is defining the next stage of Bitcoin’s evolution, potentially impacting the pricing, adoption and strengthening its role in the broader financial landscape of the world.

Our Bitcoin mixer publishes a weekly roundup

of interesting news from the world of cryptocurrencies.

Visit our blog: Mixer.money