- The increase in rates and probability of recession do not impact the market as much as they did before

- Will stocks continue to suffer from the growing rates and inflation?

- How have the increasing rates influenced the cryptocurrency and commodity markets?

- Conclusion

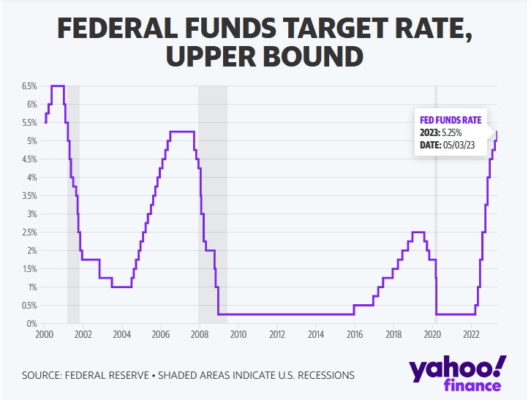

After the Silicon Valley Bank’s collapse in March and the subsequent banking crisis, the Federal Reserve has raised interest rates for a tenth time in a row on May 3. In March, inflation in the U.S. reached 5%. It is unclear whether the FRS will raise the rates again in June but crypto is one of the best investment opportunities right now.

Over the last year, the increase in FRS rates has impacted stocks, crypto, and commodities including oil. What should investors expect from now onwards and how long will the rising rates affect markets?

The increase in rates and probability of recession do not impact the market as much as they did before

The U.S. markets have sagged since cryptocurrency and many risky stocks reached their peaks in November 2021. However, the investors are not as afraid of the continuing increase in the FRS rates as they expect the FRS to follow its path in the short term.

“I think markets are far less anxious about interest rate hikes now than in Q3 and Q4 2022. With the better-than-expected recent inflation numbers, the FRS and investors feel like they have some control on inflation. It seems now everyone sees a path to an eventual holding off of rate hikes,” said Dan Raju, Chief Executive Officer and Co-Founder of Tradier, a cloud-based financial services provider and a brokerage platform.

It is unclear whether there will be a recession and how severe it could get, according to Brian Spinelli, co-chief investment officer at Halbert Hargrove, a wealth advisory and fiduciary investment firm in California.

“Stocks are forward-looking and our best estimate is a mild recession has been anticipated in current prices.”

This means that markets can drop even further if the economic situation gets worse.

“When the FRS introduced restrictive monetary policies by increasing rates in 2022, this caused equity markets and cryptocurrencies to appropriately decline in valuation,” said Octavio Sandoval, director of investments at Illumen Capital.

2022 was a rough year for unprofitable hypergrowth stocks. For example, some software stocks, including Cloudflare and Datadog, have decreased by more than 50% compared to their all-time-high levels. The same is true for crypto: Bitcoin is worth around 60% of the price at its peak in November 2021. Ethereum, the world’s second-largest cryptocurrency by value and market capitalization, has also experienced a similar decline over that period.

Will stocks continue to suffer from the growing rates and inflation?

Crypto and stocks have experienced volatility and investors have taken into consideration the increasing rates. What should they expect until the end of 2023, now that the rates are likely to have reached their maximum levels or are close to them?

“Cost of capital for companies is going up, there are arguably tighter lending conditions for consumers and there is still uncertainty about the level at which the FRS pauses its rate hikes to try and tame inflation,” Spinelli commented.

The fact that there is less money circulating in the economy is unfavorable for investments in general. Observers are still unsure whether the FRS will do too much or too little and whether the next moves are already priced into stocks. This uncertain situation contributes to market volatility.

How have the increasing rates influenced the cryptocurrency and commodity markets?

The response of two asset classes to the increasing rates has been remarkably different. Crypto prices have decreased as well as other risky assets, while many commodities, including oil, grew in the beginning of 2022. Still, the trend did not last long. Since the increase in rates is expected to slow down or stop, it seems that both oil and cryptocurrencies have reached their bottom.

“Higher rates generally lower appetite for riskier investments and that is likely one of the causes for a significant pullback in digital asset prices over the last year,” Spinelli said.

Crypto followed other risky assets with a drop caused by reduced liquidity when the Federal Reserve System announced in November 2021 that it was going to increase its rates — a trend that continued in 2022. Moreover, the collapse of some currencies and platforms, including FTX, has seriously undermined the confidence of investors in virtual assets. However, the crash of Silicon Valley Bank motivated many investors to raise the price of crypto and rely on the assumption that the rate increase trend would change.

Conclusion

Interest rates grew rapidly last year, and investors are wondering whether they will continue to increase throughout 2023. For long-term investors, this might be the perfect moment to find great investment opportunities at bargain prices.